Bitcoin price started dropping in June, following the news of the German government’s intention to sell $150m Bitcoin despite positive ETH ETF news.

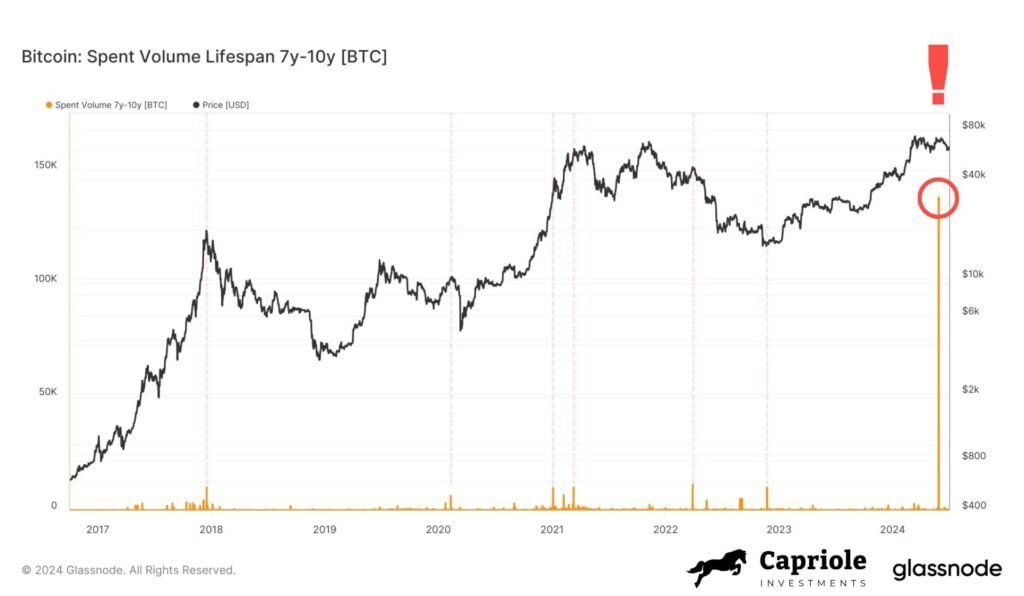

Mt.Gox may have started repaying creditors. According to a recent Bitcoin transfer volume chart for tokens last moved in the past seven to 10 years shared by Charles Edwards, the founder of digital asset hedge fund Capriole Investments.

Read Also: BlackRock’s $400 million iShares ETF to exit Nigeria

Edwards shared in a July 2 X post:

“The entire history of this chart has disappeared because an enormous sum of Bitcoin moved on-chain, 10X more than the previous highs. $9B. But by who? Mt. Gox. It looks like those distributions really are coming.”

Mt.Gox will be repaying 127,000 creditors a total of $9.4 billion in bitcoin, which majorly will be absorbed by institutional investors when creditors keep selling.

Meanwhile, the news of one of these wallets moving $2.7 billion worth of bitcoin has shredded down the price to a low of $53,499 on coinbase.

Crypto liquidations near $665M. Around $222 million in long Bitcoin positions were liquidated in the past 24 hours, with the price of BTC hitting its lowest point since February. The highest in two months as reported by CoinGlass.

Discover more from DiutoCoinNews

Subscribe to get the latest posts sent to your email.