Enaira Whitepaper is live with guidelines on the plans for future launching

The Central Bank of Nigeria (CBN) released the e-Naira design guidelines which breaks down the objectives, principles, and the eNaira design plan.

The design paper praised Distributed Ledger Technologies (DLTs) for their ability to offer transparency, secure, and tamper-proof transactions while creating trust among transacting parties.

The document reads in part:

“This design document gives much more detail on the critical dimensions of the eNaira, including the eNaira design and architecture, the initial eNaira functionality, what roles different economic actors play as the eNaira is introduced, the risks of the eNaira and how they will be mitigated, and the eNaira Implementation roadmap.

These critical details should give comfort to Nigerians that the eNaira has been well-conceived and the launch of the eNaira has been robustly planned.”

– Central Bank of Nigeria (CBN)

Below is a highlight of the eNaira white paper:

- The eNaira will be a hybrid or a two-tiered CBDC architecture – CBN will issue the CBDC, including managing the central ledger of all transactions, while leveraging the existing financial system

- The eNaira is based on Hyperledger Fabric variant of the DLT – this will allow the CBN to manage wallets while financial institutions and regulated market players will act as nodes on the network

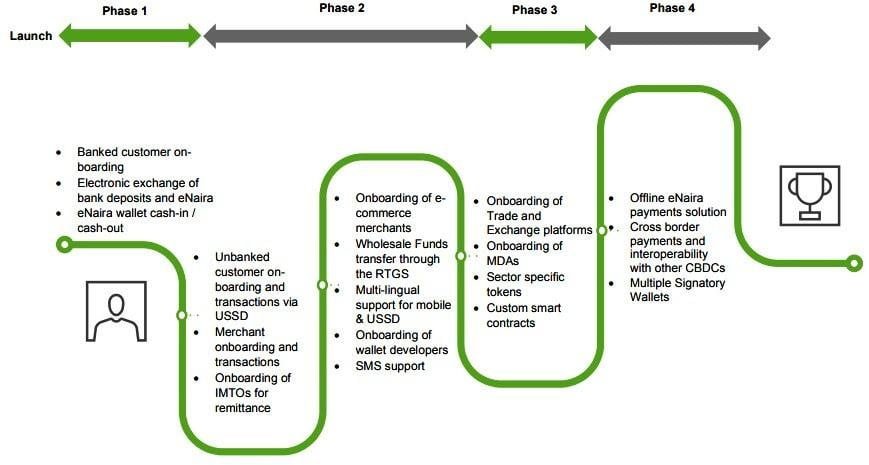

- The eNaira full implementation will be in 4 phases

- The eNaira will use existing identity infrastructure – BVN, NIN, TIN etc. – to uniquely identify individuals and corporate entities to ensure a robust KYC framework

- The Bank Verification Number (BVN) and the National Identity Number (NIN) will serve as unique identifiers for the eNaira tier structure – each wallet will be tied to the BVN or NIN to prevent duplicate identities and wallet creation

- The eNaira will not earn interest

- The role of AML / CFT checks will be handled by financial institutions who have close proximity to customers

CBN says it will collaborate with stakeholders to clearly articulate use cases that solve current needs, define clear value propositions, and conduct sensitization campaigns to ensure the success of the CBDC.

Read / Download the design white paper below

Discover more from DiutoCoinNews

Subscribe to get the latest posts sent to your email.