Halving Dump: This is the 4 Main Reasons Why Bitcoin Dropped $10K to $8.1K

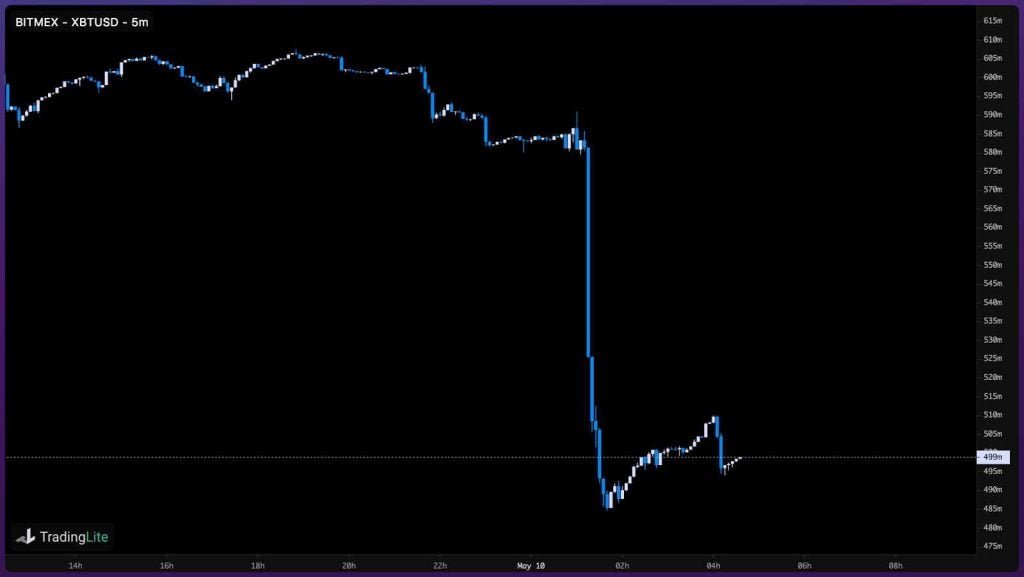

Bitcoin (BTC) price dropped from $10,000 to $8,100 within just 24 hours. Bitcoin price went down by 9% in a single hour. It liquidated $200 million worth of longs, destroying the futures market.

The four main reasons that caused the immense Bitcoin correction according to experts were:

- Strong multi-year resistance area above $10,000.

- Whales moving to short the market on BitMEX.

- Extreme volatility Ahead of halving.

- Holders Looking to Sell For Profit.

Strong multi-year resistance area above $10,000:

Since mid-2018, Bitcoin had been hovering around $10,200 to $10,500 range. This is a historically strong area of resistance for the top-ranking cryptocurrency by market capitalization.

Bitcoin failed to move above the first breakout level of $10,500 that led to the sharp run to $14,000 in June 2019. This is the only sharp run above $10,500 level in six times period.

Remember that the Bitcoin price initially broke down at $10,100 on May 8. This break down signaled a key resistance rejection for Bitcoin at $9,900 making it vulnerable to a sharp correction.

Whales rushing to short the market on BitMEX:

At $9,900 key resistance rejection level, whales started selling causing a disastrous long contract liquidations mostly on BitMEX and Binance Futures. Just under one hour, over $200 million worth of longs were liquidated.

Read Also: Beginners Guide to Binance Spot Trading: What is Spot Trading and How to Use it on Binance.

Whales start selling almost after the rejection of $10,200 was confirmed. There was a desperate move to short Bitcoin across major cryptocurrency exchanges including Binance Futures, BitMEX, Deribit, and OKEx.

Therefore, whales trading against Bitcoin (BTC) at a critical reversal point of a long-term trend caused a sharp drop in a short period of time.

Extreme Volatility Ahead of Halving:

With the bitcoin block reward halving happening on May 12, trading activity on all major cryptocurrency platforms increased to the extent the coinbase went down and couldn’t process orders again.

It appears that the market usually opens up for a sharp selloff during major crypto events as a result of previous high volumes reached during this period.

Remember that Bitcoin price dropped by more than 30 percent at the 2016 block reward halving.

Holders Looking to Sell For Profit:

Many Bitcoin holders moved their Bitcoin holding to exchanges for sale during these period. At around $9,900 key resistance rejection level, whales started selling off causing a disastrous long contract liquidations.

Meanwhile, many other trades who have been waiting for the next Bitcoin block rewards halving, who are holding after the 2018 price drop starting selling off out of hope of another Bitcoin bubble.

Discover more from DiutoCoinNews

Subscribe to get the latest posts sent to your email.